NFTs Industrialize the Gameplay Loop… That’s a Terrible Idea

The Commodification of Games

NFTs will destroy video games if industry-wide adoption occurs. This is not, well mostly not, hyperbole. NFTs mean the ability to commodify things that were previously not commodifiable. Translated into a gameplay loop, this becomes the widely-touted “Play-to-Earn” business model, wherein in-game assets become convertible into some form of tokenized currency, which can then be traded on a Cryptocurrency exchange. This attaches, on a systems-design level, a dollar-value to in-game items, in-game playtime, and subjects gameplay itself to exchange rates, general economic principles, and fundamental incentives which are profit-seeking, and for the most part, rent-seeking as well.

Gamers can sense something problematic about NFTs, which is why large publishers have faced pushback when it came to NFT adoption, but the complaints are both too broad and too narrow. There is the general sentiment of “keep out the apes” which is impossible to disagree with, but there is a vaguer notion of NFTs being a scam which doesn’t fully articulate how NFTs will affect the core gameplay loops in any game they are implemented in and how that poisons game design by industrializing gameplay. This article will cover what that means.

Axie Infinity

The best example of industrialized gameplay is a game called Axie Infinity, which operates on the Play-to-Earn model. Ostensibly, Axie is a card-based PvP game where players compete with teams of three creatures known as “Axies,” which all have randomized attributes and are, in turn, all tokenized.

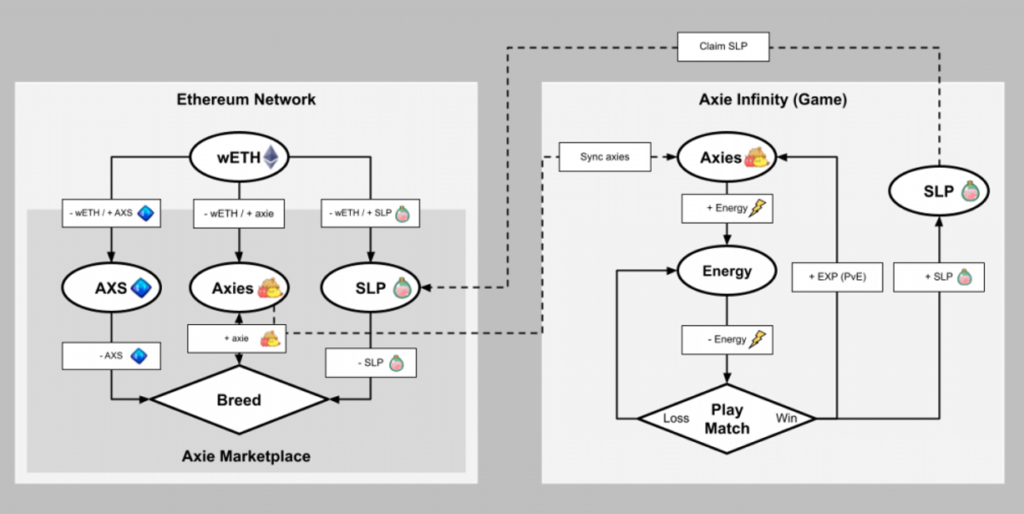

Axie Infinity is based on Ethereum, but due to the prohibitive transaction costs of Ethereum, it functions on a side-chain known as Ronin. This side-chain has a governance currency called AXS, character tokens called Axies, and an in-game currency called Smooth Love Potions. All of these currencies are essentially money, subject to exchange rates, and correlate directly to a dollar amount.

This is what a proto-Play-to-Earn model looks like. Game mechanics that are tokenized in a way that abstracts direct dollar earnings into vaguely gamified elements. It is a veneer of a game overlaid on top of an accounting spreadsheet. Let me explain.

As you can see from the diagram above, the exchange between Ethereum/Ronin and the game lies in the in-game currency known as Smooth Love Potions (SLP), all of the gameplay revolves around optimizing SLP generation which translates into a certain dollar value, subject to exchange rates. Here is how the economics of Axie Infinity functions:

SLP is used to breed Axies and form the basis of the economy. They are the fungible currency in the game. SLP is earned through ranked matches, which costs energy to play (which recharge every day – think mobile game design), the number of energy a given player has access to ranges according to the number of Axies owned, from 20-60. More SLP means more Axies, translating to a larger Axie stable, which means more energy to play matches.

Invest-and-Earn

This all sounds relatively abstracted, so from a business perspective, this is how it works: SLP is the desired output, it is the exchange currency that allows a player to “lock-in” their earnings. However, players have different earning potentials. SLP means more Axies, which means the ability to earn more SLP per day. Imagine there are ten lemonade stands operating on the same street, but county ordinance requires a certain baseline production of lemonade per day to be open for business longer. This effectively locks out the lemonade stands which don’t have the capital to invest in higher lemonade production. This is how Axie Infinity works.

The capital requirements for Axie Infinity are high. A player requires a baseline amount of Axies to be able to play enough games in a day to attain profitability. This had led to Axie “scholarships” which are companies that give players access to a pool of Axies with which to play while not granting access to the underlying wallet. And then give players a portion of the SLP earned. This is not so much Pay-to-Play as it is a direct recreation, minus the regulation, of a wage-based economic system.

These scholarships, such as Pegaxy, monopolize all of the earnings while paying a wage in SLP to Axie “scholars.” The capital costs involved with playing a Pay-to-Play game, which is critical for the profitability of publishers, means that operating at scale is the only way to sustainably make a living playing these games. Axie is less of a Pay-to-Play game and more of an Invest-to-Earn game, it is industrialized capitalism in its most distilled form. Prohibitive costs put power in the hands of capital, not gamers.

And since the economic model is the entire game, most of these Pay-to-Play games are, to put it kindly, simply not fun to play. Axie Infinity relies on players getting involved for fun, and that simply doesn’t exist. The majority of players, “treat the game as a job and thus have little interest in-game items for their own sake, once they have enough stuff to cover their job, they stop reinvesting and cash out.” Compare this with World of Warcraft or any other largescale MMO. A similar issue exists with Real Money Trading and we can speak from experience. Yes, RMT exists, but the commodification of gameplay assets is peripheral – it isn’t the focus.

The market for RWT is not insignificant, but also not widespread. Only a fraction of players engages in RWT, even in games where these types of transactions are more common, such as OSRS. One of the key appeals of RWT is precisely that: not all players engage, have access to, or are aware of it. This gives buyers an advantage that exists in a space outside of the gameplay loop. RWT provides a marginal benefit because it is an option not sought out by the majority of gamers. RWT doesn’t skew incentives of a gameplay loop as a whole. The entire business model only exists because there is an underlying game with rules that the majority of the player base follows.

Pay-to-Play industrializes games. It skews the incentives of game design. The entire gameplay model becomes profit-driven, there are no longer regular players to get an advantage over. Once a player has comfortably recouped their initial investment, there is no more incentive to keep engaging. It industrializes gaming wherein operating at scale and for-profit becomes the optimal way to play, because gaming for the sake of gaming is no longer the incentive, only the dollar calculus remains.

“NFTs will destroy video games if industry-wide adoption occurs. This is not, well mostly not, hyperbole.”

It is though. NFTs as a technology don’t bring anything to games that wasn’t possible before in a centralized way. You could’ve traded hats in TF2 many years ago but most players didn’t care much for it because it wasn’t exactly great fun. Diablo3 straight up released with a real money auction house and it failed because endlessly grinding for peanuts wasn’t particularly popular. The same will be the case for shitty NFT implementations in coming games. I have no doubt they’ll ruin some games for the sake of pushing NFTs but let’s not pretend Ubisoft wouldn’t do that without them anyway.

Publishers might be big and quite influential but they can’t dictate what we consider fun/entertaining in the long run and if they dare go against it with some open world NFT grinding clown game it’ll fail.

tl;dr: greedy devs will ruin games with or without the blockchain